how to do income tax

By mailing or electronically filing forms to the IRS by filing with tax preparation software or by seeking the help of a tax. The IRS began accepting and processing federal tax returns on January 24 2022.

Inkwiry Federal Income Tax Brackets

Your household income location filing status and number of personal.

. If you do not know last. You can lodge your individual tax return. How Do Income Taxes Work.

You can file manually by completing Form 1040 according to instructions provided by the IRS. Becoming a tax preparer is a straightforward process involving a few basic requirements. How To File a Tax Return You have three options when it comes to filing your taxes.

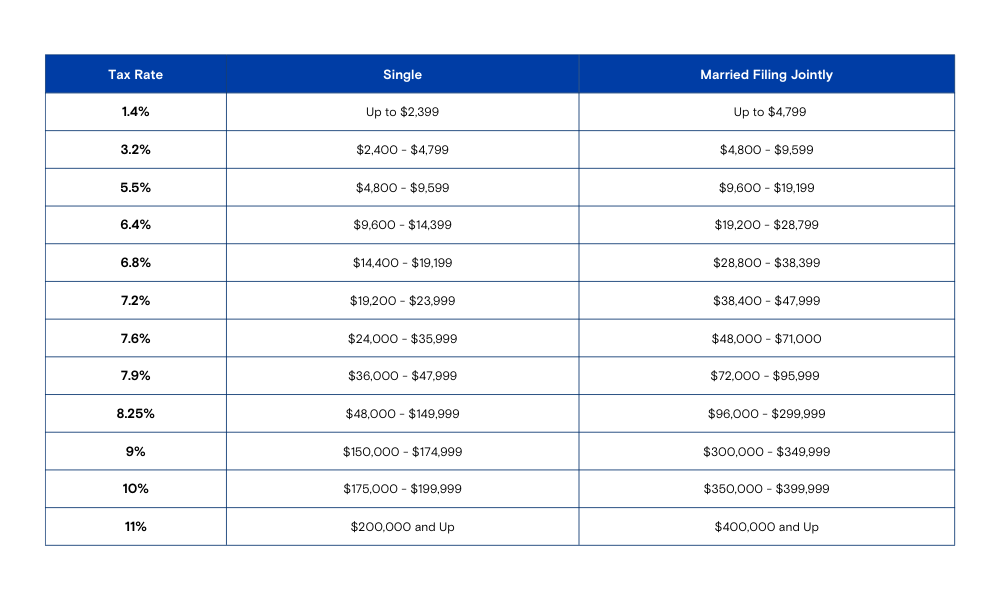

You likewise have the choice to e-check your duty account. There are three primary ways to file your taxes. The income tax rate varies for individuals based on the amount of income that they make in a year.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. To file your taxes enter your information through the automated phone line. To get your tax return started youll first need to find out how.

6 steps for first-time tax filers Filing your federal income tax return can seem overwhelming. For most new tax preparers learning the ins and outs of the business. Invited people with a low or fixed income and a simple tax situation.

In 2022 ordinary income tax rates range from 10 to 37. This is the system your employer or pension provider uses to take Income Tax and National. Income Tax is a tax you pay on your income.

Individual Income Tax Return PDF it can take 6 to 8 weeks to process your return. Every spring employers file W-2 forms on behalf of their employees and Americans fill out federal income tax returns on forms with opaque. You do not have to pay tax on all types of income.

The tax rate that applies to your income depends on your filing status and how much you make. Start by calculating your taxable income after deductions. You will then be asked to create a new password for your new online.

Select the affirmation number to download the income tax certificate form ITR-V. Take your 100000 in earnings and subtract 7065 half your 14130 self-employment tax. How you pay Income Tax Pay As You Earn PAYE Most people pay Income Tax through PAYE.

You pay tax on things like. Here are 5 ways to reduce your taxable income 1. Lodging by myTax or through an agent is the fastest way to lodge your return.

To sign your electronic tax return use a 5 digit self-select PIN any five numbers except all zeros that you choose which serves as your electronic signature. To e-check select the option Snap here to see. Once you have your new PIN navigate to the new MyTax website and login using the First Time Login option.

Locally hired foreign mission employees If you are permanently resident in the United States for purposes of the Vienna. Enroll in an employee stock purchasing program If you work for a publicly traded company you may be eligible to enroll in. This will include all the components of your salary including House Rent Allowance HRA Leave Travel.

This guide is also available in Welsh Cymraeg. E-Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries 1800 103 0025 or 1800 419 0025. But you can tackle tax season one step at a timeand avoid rookie mistakeswhile you take.

Online with myTax with a registered tax agent by paper. E-File Options including Free File If you mail a paper Form 1040 US. The different levels of individuals income that determine the level of income.

Calculate your gross income First write down your annual gross salary you get. File a Federal Income Tax Return. Income tax information for A or G visa holders.

.png)

Form W 9 What Is It And How Is It Used Turbotax Tax Tips Videos

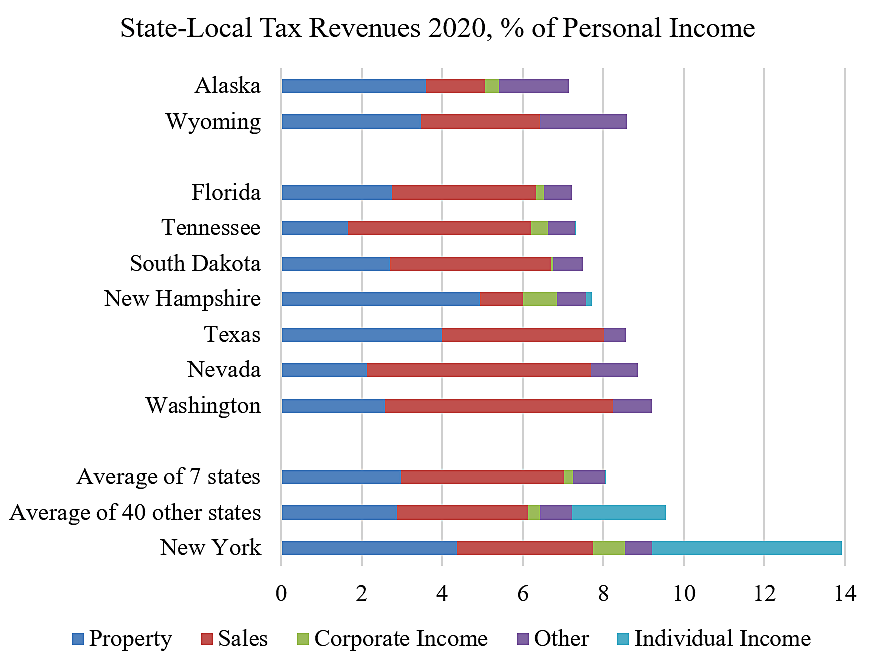

Do States Need Income Taxes Cato At Liberty Blog

How Do Food Delivery Couriers Pay Taxes Get It Back

Preparing To File Your Federal Tax Return Regions

Do New Jersey Residents Working From Home Still Have To Pay New York Income Taxes Cbs New York

Free Online Tax Filing E File Tax Prep H R Block

Do You Have To File Taxes If You Make Less Than 1000

Do I Need To File A Tax Return Forbes Advisor

What S The Racket About Tax Brackets A Look At How Tax Brackets Work Bank Of Hawaii

What Is Income Tax And How Are Different Types Calculated

How To Determine Your Tax Bracket Mintlife Blog

/TermDefinitions_Incometax_finalv1-2c3f527bde3a41c296b6389fda05101d.png)

What Is Income Tax And How Are Different Types Calculated

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

Understanding How Income Taxes Work Smartasset

How To File A Zero Income Tax Return 11 Steps With Pictures

How To File Taxes Online 13 Steps With Pictures Wikihow

Summary Of The Latest Federal Income Tax Data Tax Foundation

Why Do People Pay No Federal Income Tax Tax Policy Center

0 Response to "how to do income tax"

Post a Comment